uchebniki-chitat.ru

Market

Long Term Etf Or Mutual Fund

Of course, investors who realize a capital gain after selling an ETF are subject to the capital gains tax. Currently, the tax rates on long-term capital gains. Using active management and research-driven analysis, investment professionals can identify those stocks considered most attractive for current market. Even though I am buy and hold long term, I like that I can see my performance in real time with ETFs. I don't see any advantage of mutual funds. But ETFs are also a cost-efficient way to build a long-term, core portfolio. ETFs are one-third the price of the average active mutual fund. the price. Compare ETF vs. mutual fund minimums, pricing, risk, management, and costs, then weigh the pros and cons. Both ETFs and mutual funds are professionally managed, pooled investment vehicles. They offer investors broad market exposure at a cost that's generally lower. Unlike ETFs, mutual funds can be purchased in fractional shares or fixed dollar amounts. ETFs have implicit and explicit costs. While your broker will. Mutual Funds vs ETF: The Difference ; There is no minimum lock-in period for ETFs, allowing investors to buy and sell at their convenience. Mutual funds also don. Compare ETF vs. mutual fund minimums, pricing, risk, management, and costs, then weigh the pros and cons. Of course, investors who realize a capital gain after selling an ETF are subject to the capital gains tax. Currently, the tax rates on long-term capital gains. Using active management and research-driven analysis, investment professionals can identify those stocks considered most attractive for current market. Even though I am buy and hold long term, I like that I can see my performance in real time with ETFs. I don't see any advantage of mutual funds. But ETFs are also a cost-efficient way to build a long-term, core portfolio. ETFs are one-third the price of the average active mutual fund. the price. Compare ETF vs. mutual fund minimums, pricing, risk, management, and costs, then weigh the pros and cons. Both ETFs and mutual funds are professionally managed, pooled investment vehicles. They offer investors broad market exposure at a cost that's generally lower. Unlike ETFs, mutual funds can be purchased in fractional shares or fixed dollar amounts. ETFs have implicit and explicit costs. While your broker will. Mutual Funds vs ETF: The Difference ; There is no minimum lock-in period for ETFs, allowing investors to buy and sell at their convenience. Mutual funds also don. Compare ETF vs. mutual fund minimums, pricing, risk, management, and costs, then weigh the pros and cons.

ETF shares typically have higher liquidity than mutual fund shares. Investing in ETFs might be a good choice if you: Trade actively—Shareholders can sell short. But ETFs are also a cost-efficient way to build a long-term, core portfolio. ETFs are one-third the price of the average active mutual fund. the price. ETFs often generate fewer capital gains for investors than mutual funds. This is partly because so many of them are passively managed and don't change their. Many mutual funds are actively managed while most ETFs are passive investments that track the performance of a particular index. · ETFs can be more tax-efficient. The choice comes down to what you value most. If you prefer the flexibility of trading intraday and favor lower expense ratios in most instances, go with ETFs. A notable difference is that Mutual Funds trade only once per day while ETFs trade throughout the day, similar to an ordinary stock. Management fees for ETFs are generally lower than other investment solutions, particularly for funds that investors plan to hold for the long term. As with. Funds that invest in longer-term bonds tend to have higher interest rate risk; and,. • Prepayment Risk—the chance that a bond will be paid off early. For. Exchange-traded-funds, or ETFs, are similar to mutual funds in that they invest in a basket of securities, such as stocks, bonds, or other asset classes. As a result, they are among the best-suggested investment vehicles for long-term investors. You can learn how Exchange Traded Funds (ETFs) can help you meet. The main difference is that ETFs can be traded throughout the day, just like an ordinary stock. Mutual funds, on the other hand, can only be sold once a day. Attractive returns: Like all stocks, major indexes will fluctuate. But over time indexes have made solid returns, such as the S&P 's long-term record of. Diversification; Low operating expenses; Good long-term outlook; Potentially lower taxes. Index fund drawbacks. Mutual funds might make more sense in certain situations, while an ETF might be a better pick in others. Both could have a place in your portfolio. — Raj Kohli. An ETF (exchange-traded fund) is an investment that's built like a mutual fund—investing in potentially hundreds, sometimes thousands, of individual securities—. There's more to building your portfolio than buying stocks, bonds and mutual funds. Have you considered exchange-traded funds (ETFs)?. For some investors, liquid investments take precedence over long term investments. Exchange Traded Fund (ETFs) offer more flexibility and better returns in the. For some investors, liquid investments take precedence over long term investments. Exchange Traded Fund (ETFs) offer more flexibility and better returns in the. In exchange, investors receive a share of that investment pool, in the form of unit(s) of the fund or ETF. Both types of products are immensely popular with. The choice might not be very important. The media and other literature usually presents the contrast as between ETF investing and traditional, high-cost, active.

Easiest Credit Card To Get Approved For Philippines

Easy Approval Credit Card. Apply for a credit card in simple steps and get your virtual card details online once the card is approved. For steps on how to. earn the maximum available rewards on every purchase you make with a credit card. make it easier for you to get approved for the new credit card. The Bottom. Choose the credit card that will fit in your lifestyle! Live life lighter with RBank credit cards. Easy and fast application online. Apply Now! Platinum Mastercard from Capital One. Get the credit you need with no annual fee. Find out if you're pre-approved with no risk to your credit score. Crime: Confidence games (con games), pickpocketing, Internet scams, and credit/ATM card fraud are common. make it easier to locate you in an emergency. This plan includes a Pomelo Secured Mastercard® that allows you to send money to the Philippines and may help to build your credit over time. Learn more about. Easily compare and apply online for a Visa credit card. Find Visa credit cards with low interest rates, rewards offers and many other benefits. Credit Cards · BPI Gold Rewards Card · BPI Platinum Rewards Card · BPI Rewards Card · BPI Signature · BPI Amore Platinum Cashback Card · BPI Amore Cashback · Petron. Try Banco De Oro (BDO), Citibank, and Metrobank. As long as your present them your tax return, they would readily give you a credit card. Easy Approval Credit Card. Apply for a credit card in simple steps and get your virtual card details online once the card is approved. For steps on how to. earn the maximum available rewards on every purchase you make with a credit card. make it easier for you to get approved for the new credit card. The Bottom. Choose the credit card that will fit in your lifestyle! Live life lighter with RBank credit cards. Easy and fast application online. Apply Now! Platinum Mastercard from Capital One. Get the credit you need with no annual fee. Find out if you're pre-approved with no risk to your credit score. Crime: Confidence games (con games), pickpocketing, Internet scams, and credit/ATM card fraud are common. make it easier to locate you in an emergency. This plan includes a Pomelo Secured Mastercard® that allows you to send money to the Philippines and may help to build your credit over time. Learn more about. Easily compare and apply online for a Visa credit card. Find Visa credit cards with low interest rates, rewards offers and many other benefits. Credit Cards · BPI Gold Rewards Card · BPI Platinum Rewards Card · BPI Rewards Card · BPI Signature · BPI Amore Platinum Cashback Card · BPI Amore Cashback · Petron. Try Banco De Oro (BDO), Citibank, and Metrobank. As long as your present them your tax return, they would readily give you a credit card.

Philippine National Bank MasterCard (web ) site was put up to answer its valued clients' inquiries over the Internet. Go to the issuer's online facility for credit card applications. Choose your bank card then click “Apply Now” button. Fill out the needed information on the. Purchase Rate: Variable APR. To receive a Citi® Secured Mastercard®, you must meet our credit qualification criteria, which includes a review of your. Credit cards offer exceptional benefits, rewards, services and spending power that can help make your financial and personal dreams come true. ✓ Choose your preferred HSBC Credit Card and Apply Online via Finmerkado Website and Get Approved Quickly! Apply Online to my refferal link https://invle. co/. Get started in three easy steps. Here are the eligibility requirements Debit or major credit card with Visa® or Mastercard® logo; Major retail. Hero Image - Credit Card (Base). Credit Cards. Having the right card can make your life easier. Browse our selection and find the one that fits your lifestyle. Although it's typically easier for consumers to qualify for a store credit card than for a major credit card, store cards may be used only to make purchases. The AUB Easy MasterCard is the only credit card that gives you the freedom to choose when and how much you want to pay! Now you can have a credit card at your. The Bank of America® Customized Cash Rewards Secured Credit Card is one of the easiest travel credit cards to get approved for because it is available to people. Basic Credit Card – Also known as standard or classic credit cards, basic credit cards are among the easiest cards to qualify for because their minimum income. Bank of Commerce credit card is accepted in more than 30 million affiliated establishments worldwide. All your purchases will be billed and paid in Philippine. The LANDBANK Credit Card provides the means for the cardholder to conveniently and safely make cashless purchases from Mastercard accredited merchants. Move your other credit card balances to your new PNB Credit Card with low interest rates for easier payments. Bureau of Immigration Approved Order. The CareCredit credit card can help pay for health, wellness, and medical costs with special financing options. Learn how it works and apply today! American Express Made Moving to the United States Easier with The Credit Passport® by Nova Credit! Browse FAQs & Learn More to Apply for an Amex Card. Applying online is the easiest way to get a credit card. Before you get started, shop around to find the best card & ensure that you only submit your. Getting a Philippine Peso card can make managing your money easier when you travel to Philippines. Both Visa and Mastercard are globally accepted. Look out. A debit card looks like a credit card but works like an electronic check. Why? Because the payment is deducted directly from a checking or savings account. Easily compare and apply online for Fair credit score credit cards with Visa. Find Visa credit cards with low interest rates, rewards and other benefits.

How To Get Free Money In Your Bank

Use a money-transfer app · Consider a bank-to-bank transfer · Set up a wire transfer · Request your bank send a check. A bank transfer lets you move money from one bank account to another. It's usually instant, free and done using mobile or online banking, over the phone or in. To qualify for the $ cash bonus, you are required to open a new, qualifying Huntington Platinum Perks Checking account by October 7, and make cumulative. Discover Green Dot's Cash Back Bank Account which offers the richest debit card with cash back, free cash deposits, and free ATM withdrawals! It can determine whether you can get credit, how good or bad the terms for getting credit are, and how much it costs you to borrow money. Learn how to get your. There are a million small ways to save money. Read our tips and learn more about how First Bank can help you make smart financial decisions. Having a deposit account with a bank can offer you savings from check-cashing fees. Depositing checks is free in a bank. Paying bills can be cheaper without. Earn creds. Make bank. Learn money. A phone held by a dark-skinned hand shows the Copper Earn dashboard screen. Get your pay up to 2 days earlier (or sooner) · No need to switch your bank · Your money, your speed. Use a money-transfer app · Consider a bank-to-bank transfer · Set up a wire transfer · Request your bank send a check. A bank transfer lets you move money from one bank account to another. It's usually instant, free and done using mobile or online banking, over the phone or in. To qualify for the $ cash bonus, you are required to open a new, qualifying Huntington Platinum Perks Checking account by October 7, and make cumulative. Discover Green Dot's Cash Back Bank Account which offers the richest debit card with cash back, free cash deposits, and free ATM withdrawals! It can determine whether you can get credit, how good or bad the terms for getting credit are, and how much it costs you to borrow money. Learn how to get your. There are a million small ways to save money. Read our tips and learn more about how First Bank can help you make smart financial decisions. Having a deposit account with a bank can offer you savings from check-cashing fees. Depositing checks is free in a bank. Paying bills can be cheaper without. Earn creds. Make bank. Learn money. A phone held by a dark-skinned hand shows the Copper Earn dashboard screen. Get your pay up to 2 days earlier (or sooner) · No need to switch your bank · Your money, your speed.

There's no credit checks or history required to apply. Make the most of your money. Get paid faster, build your credit history. Looking for the best mobile banking app? Millions of people use Dave for cash advances, side hustles, and banking accounts with fewer fees. Make the switch! Better Money Habits® offers free, easy-to-understand tools and resources that are available to all, helping people make sense of their money and take action to. Many investors and banks have not invested because they think there's too much risk involved. Then John and Kelly learn about SBA-backed loans and get the money. We've been helping people manage their money since Accessible. We have branches in 11 states, with more than 1, full-service locations. as a new Chase checking customer, when you open a Chase Total Checking® account and make direct deposits totaling $ or more within 90 days of coupon. And the cash outs are soo easy. You just have to connect in your cards to the wallet app. I have had this for under 4 months and play the games in my free time. Generally, any financial institution, such as a bank or credit union, will have money orders, or you can go to a U.S. post office. Many supermarkets and. With Zelle®, you can pay and get paid free and fast with your checking account. your money moves fast—directly into the enrolled recipient's bank account. Send money to friends and family no matter where they bank in the U.S., using the Bank of America Mobile Banking app with Zelle®. Simple, ask your friends and or all your relatives one to deposit money in your bank on a monthly of minimum of Rs. 10/— as you don't want to. Send and receive money with friends and family, no matter where they bank in the U.S. - Using Zelle® is fast and free in the Bank of America app. Fee or Free? There are some bank accounts that charge a monthly fee, in return you might get travel insurance, cashback or a better rate of interest. But for. Zelle® is a fast, safe and easy way to send and receive money with friends, family and others you trust. Look for Zelle® in your banking app to get started. A cash crisis can happen to anyone. At StepChange Debt Charity, we've got free advice and resources if you urgently need help. Get in touch with us today. Let's get you free money for college. Granny California babies, regardless of family income, get money in a CalKIDS college savings account at birth. a fee – and you have a choice of speeds. Use free standard delivery to receive the funds in your U.S. Bank account in two to three business days. For more. It's free to send and receive money, stocks, or bitcoin** within Cash App. Cash App is a financial services platform, not a bank. Banking services are provided. Direct deposit provides automatic, electronic transfers of money directly to a bank account. This service is free. You must have a bank account to use this.

The 4 Rule For Retirement

:max_bytes(150000):strip_icc()/four-percent-rule-d7211cfc9d234935a4b0ece63f30b930.jpg)

In theory, this formula means that “under a worst-case investment scenario, your savings should still last 30 years,” says Karen Birr, manager of retirement. The 4% Rule is a popular retirement strategy, but factors such as asset allocation, fees, and inflation must be taken into account. The idea is to save the target amount before you retire, then use the 4% rule to guide your withdrawals after. Keep in mind that this strategy doesn't account. 2. The 4 rule According to the 4 rule, one can withdraw 4% of their retirement savings in the first year of retirement and adjust subsequent withdrawals for. According to one oft-quoted rule of thumb, retirees should look at tapping into about 4% of their savings annually. Simply put, the 4% withdrawal rule states that, all things being equal, if you continue to draw down 4% of your retirement nest egg each year, there is a great. If you withdrew no more than % of your portfolio in the first year of retirement, and adjusted it annually thereafter for inflation, there was a 90%. The 4% Rule is designed to provide an increasing income during retirement. In other words, it's an income that adjusts—at least somewhat—with inflation. The 4% rule is a guideline for retirement spending, suggesting that one should be able to withdraw 4% of their retirement savings annually without running out. In theory, this formula means that “under a worst-case investment scenario, your savings should still last 30 years,” says Karen Birr, manager of retirement. The 4% Rule is a popular retirement strategy, but factors such as asset allocation, fees, and inflation must be taken into account. The idea is to save the target amount before you retire, then use the 4% rule to guide your withdrawals after. Keep in mind that this strategy doesn't account. 2. The 4 rule According to the 4 rule, one can withdraw 4% of their retirement savings in the first year of retirement and adjust subsequent withdrawals for. According to one oft-quoted rule of thumb, retirees should look at tapping into about 4% of their savings annually. Simply put, the 4% withdrawal rule states that, all things being equal, if you continue to draw down 4% of your retirement nest egg each year, there is a great. If you withdrew no more than % of your portfolio in the first year of retirement, and adjusted it annually thereafter for inflation, there was a 90%. The 4% Rule is designed to provide an increasing income during retirement. In other words, it's an income that adjusts—at least somewhat—with inflation. The 4% rule is a guideline for retirement spending, suggesting that one should be able to withdraw 4% of their retirement savings annually without running out.

The 4% rule says you can expect to safely withdraw 4% of your retirement portfolio in your first year of retirement as your initial draw amount. If your portfolio returns at least 4% annually, you can withdraw your investment gains without losing principal, which can minimize the risk of outliving your. The 4% Rule and Safe Withdrawal Rates in Retirement (Financial Freedom for Smart People) · eBook · $ The 4% rule is perhaps the most common of all retirement withdrawal strategies. Using this strategy, you withdraw 4% of your savings in the first year of. The basic rule is that you sell 4% of your portfolio the first year. This gives you a certain $ amount to cover your living expenses for that. The 4% retirement rule is a popular retirement income strategy that can provide you with a steady stream of income throughout your retirement years. Though the 4 percent rule has its flaws, it is still a reasonable starting point for retirement planning. So rather than regard it as unassailable truth, use it. The so-called 4% rule has long been a popular retirement income strategy, but it's not sustainable for everyone. Alternative strategies include delaying. If stocks average 7% after inflation, then plugging a 7% return into a spreadsheet suggests that retirees could withdraw 7% each year without ever dipping into. Bengen first developed the 4% withdrawal rate as a rule of thumb for retirement spending in Now Bengen himself is retired and able to offer insights on. The rule states that you should withdraw no more than 4% of your assets during the first year of retirement. Then, in subsequent years, you can adjust your. The rule says that if retirees withdraw 4% of their savings annually (adjusting this amount for inflation every year thereafter), their nest egg will last at. The rule says that if retirees withdraw 4% of their savings annually (adjusting this amount for inflation every year thereafter), their nest egg will last at. The 4% Rule is designed to provide an increasing income during retirement. In other words, it's an income that adjusts—at least somewhat—with inflation. The 4% rule states that you can withdraw up to 4% of your portfolio's value each year. · Beginning in the second year of retirement, you adjust this amount for. The 4% rule is a strategy that says you should withdraw 4% of your retirement savings in your first year of retirement. You should plan on withdrawing no more than 4% to 5% of your retirement savings each year, as general rule. Just multiply your total retirement savings by 4 percent. That is how much you can spend of the principle of your retirement fund each year. The 4% rule states that you can withdraw up to 4% of your portfolio's value each year. · Beginning in the second year of retirement, you adjust this amount for.

Metatrader 4 Or 5 For Forex

Unfortunately, MT5 has no backward compatibility, so you need to open separate accounts to use both. Final Word On MT4 And MT5 Trading Platforms. MetaTrader 5. MetaTrader 4, also known as MT4, is an electronic trading platform widely used by online retail foreign exchange speculative traders. While MT4 may be more suitable for beginner traders and those focused primarily on forex trading, MT5 offers additional features and functionalities that cater. MetaTrader 4 vs. MetaTrader 5 – Trading Platform Comparison. Find out all of MT4 and MT5 features and Learn why Meta Trader 5 is better than Meta Trader 4. MetaTrader 5 (MT5) is a popular electronic trading platform widely used by online retail foreign exchange (forex) brokers and traders. It is developed by. MetaTrader 5 was made to attract market brokers outside of forex, while MetaTrader 4 is still the most popular trading platform for forex and CFDs. MT4 is comparatively simpler and easier to use, especially for forex traders. · MT5 is a little more complex as it consists of more trading features and enables. MT5 has a broader feature set that comes with more technical indicators, assets, and customizability. MT4 is easier to use and operates within the Forex market. The main difference between MT4 and MT5 is that MetaTrader 5 was developed to attract market brokers beyond Forex, while MetaTrader 4 remains today's dominant. Unfortunately, MT5 has no backward compatibility, so you need to open separate accounts to use both. Final Word On MT4 And MT5 Trading Platforms. MetaTrader 5. MetaTrader 4, also known as MT4, is an electronic trading platform widely used by online retail foreign exchange speculative traders. While MT4 may be more suitable for beginner traders and those focused primarily on forex trading, MT5 offers additional features and functionalities that cater. MetaTrader 4 vs. MetaTrader 5 – Trading Platform Comparison. Find out all of MT4 and MT5 features and Learn why Meta Trader 5 is better than Meta Trader 4. MetaTrader 5 (MT5) is a popular electronic trading platform widely used by online retail foreign exchange (forex) brokers and traders. It is developed by. MetaTrader 5 was made to attract market brokers outside of forex, while MetaTrader 4 is still the most popular trading platform for forex and CFDs. MT4 is comparatively simpler and easier to use, especially for forex traders. · MT5 is a little more complex as it consists of more trading features and enables. MT5 has a broader feature set that comes with more technical indicators, assets, and customizability. MT4 is easier to use and operates within the Forex market. The main difference between MT4 and MT5 is that MetaTrader 5 was developed to attract market brokers beyond Forex, while MetaTrader 4 remains today's dominant.

InstaForex provides its clients with the modern MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms free of charge. Both platforms are developed by. MetaTrader 5 is a newer and more advanced trading platform. While MT4 revolutionized the trading world when it was released, MT5 has built upon that success and. The MT4 platform is considered one of the most famous and most important platforms in the trading process, as all forex companies offer their clients this. According to MetaTrader, MT4's trading platform provides everything required to function as a Forex or CFD trader. MT5, on the other hand, presents a multi-. Although MT4 includes most of the standard indicators you would need, MT5 includes 8 additional indicators. This is not an important difference as any indicator. MetaTrader 4 for desktop · Expert Advisors. Take advantage of trading algorithms and fully-fledged developing and testing environments. · MetaTrader Market. Take. The best trading platform for you depends on your specific trading needs and preferences. Here's a quick guide: Choose MT4 if you primarily trade forex or CFDs. MetaTrader 5 for desktop · Expert Advisors. Take advantage of trading algorithms and fully-fledged developing and testing environments. · MetaTrader Market. Take. Again, MT5 is a great platform–it's just that many find MetaTrader 4 more suitable to their preferences and trading needs. Since MetaTrader 5. MT4 and MT5 are 2 popular trading platforms, each with its own language for traders to customize according to their needs. While MT4 is easy in using and. Obviously MT4 is the better bet if you are certain you will only be trading Forex and CFDs, and you want to keep things very simple. Again, MT5 is a great platform–it's just that many find MetaTrader 4 more suitable to their preferences and trading needs. Since MetaTrader 5. It's not entirely rational to claim whether MetaTrader 4 or 5 is the better platform over its counterparty. There are certain things that the. Both MetaTrader 4 and MetaTrader 5 offer flexible setup and high order processing speed. MetaTrader uses its own high-performance servers, so orders can be. The MetaTrader 4 and MetaTrader 5 platforms from MetaQuotes Software Corporation are recognized leaders among the Forex trading software. MetaTrader 4 is a platform for trading Forex, analyzing financial markets and using Expert Advisors. Mobile trading, Trading Signals and the Market are the. Despite MetaTrader 5's additional benefits, MetaTrader 4 remains a reliable option, can perform at an advanced level and is more readily available from brokers. MetaTrader 4 (MT4) and MetaTrader 5 (MT5) stand as two prominent trading platforms globally. While MT4 boasts longevity, MT5 emerges as a. MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are the world's most dominant retail foreign exchange (forex) trading platforms. They are offered by. No, you cannot trade on your MetaTrader 4 account using a MetaTrader 5 platform. The MT5 platform is compatible only with MT5 accounts, while the MT4 platform.

Call Robinhood Support

You can change your phone number with Robinhood directly from the app. Or you can go to Contact Us → I have a different question → Account → Update your info →. Robinhood Crypto or Robinhood Money concerns. Only request phone or chat support from Robinhood through the app or at uchebniki-chitat.ru At this time, we do not have a direct dial support phone number. Robin Hood is a legendary heroic outlaw originally depicted in English folklore and subsequently featured in literature, theatre, and cinema. PissedConsumer did have luck finding the Robinhood customer phone number through other means. That number is () 24/7 customer support. Industry-leading security. Cold storage for vast majority of our customers' coins. Crime insurance against theft and cybersecurity. Robinhood Support. Hello! How can we help? Getting started General questions. How to contact supportRobinhood Referral programCheck your portfolio. If you have activity that you don't recognize or didn't authorize on your account—or have any other reason to believe it has been compromised—contact Robinhood. Contact Robinhood Support immediately by emailing [email protected] or by requesting a call from a live agent within the Robinhood app. Our team can take. You can change your phone number with Robinhood directly from the app. Or you can go to Contact Us → I have a different question → Account → Update your info →. Robinhood Crypto or Robinhood Money concerns. Only request phone or chat support from Robinhood through the app or at uchebniki-chitat.ru At this time, we do not have a direct dial support phone number. Robin Hood is a legendary heroic outlaw originally depicted in English folklore and subsequently featured in literature, theatre, and cinema. PissedConsumer did have luck finding the Robinhood customer phone number through other means. That number is () 24/7 customer support. Industry-leading security. Cold storage for vast majority of our customers' coins. Crime insurance against theft and cybersecurity. Robinhood Support. Hello! How can we help? Getting started General questions. How to contact supportRobinhood Referral programCheck your portfolio. If you have activity that you don't recognize or didn't authorize on your account—or have any other reason to believe it has been compromised—contact Robinhood. Contact Robinhood Support immediately by emailing [email protected] or by requesting a call from a live agent within the Robinhood app. Our team can take.

Disclosures. Disclosures. Was this article helpful? Reference No. Still have questions? Contact Robinhood Support · FINRA's BrokerCheck. Follow us on. Contact Member Support U.S.. Case Record Type. Record Type. Community (Region). US uchebniki-chitat.rus://uchebniki-chitat.rups://. General questions. How to contact supportRobinhood Referral programCheck your portfolio · View all · Brokerage Customer Relationship Summary · FINRA's. Only request phone or chat support from Robinhood through the app or at uchebniki-chitat.ru At this time, we do not have a direct dial support phone number. PissedConsumer did have luck finding the Robinhood customer phone number through other means. That number is () Robinhood. K Ratings. Get. Robinhood 24 Hour Market. Update on recent market volatility. Update on recent market volatility. hour trading. hour trading. In your Robinhood app, select Profile · Select Help → Contact us · Select Something else · Select Debit card → Dispute a charge. It's the same contract if the ticker symbol, strike price, expiration date, and type (call or put) are all the same. Contact Robinhood Support · Brokerage. Robinhood Support can't reverse or refund payments for you. Was this article helpful? Reference No. Still have questions? Contact Robinhood Support. My app isn't working as expected · Check your WiFi signal strength. · Ensure you have the latest version of the Robinhood app. · Force close and reopen the app. Robinhood Markets, Inc. is an American financial services company headquartered in Menlo Park, California. The company provides an electronic trading. We're here to help. Call. TD Ameritrade, Inc. account questions? Call If you don't have a check, you can call your bank and ask for this information. If you need help, contact Apple Support. Published Date: June 26, Start investing in stocks and ETFs with no add-on commission fees. Invest with any amount and get help along the way. Was this article helpful? Reference No. Still have questions? Contact Robinhood Support · Brokerage Customer Relationship Summary · FINRA's BrokerCheck. This counts as 1 day trade because you opened and closed the ABC stock position the same day. Call option exercise Contact Robinhood Support · Brokerage. Still have questions? Contact Robinhood Support · Brokerage Customer Relationship Summary · FINRA's BrokerCheck. Follow us on. DEMOCRATIZE FINANCE FOR ALL™. support at $17 would need to break to validate the pattern. With the way Robinhood Stock Rises % After Record ReportKey Takeaways: Robinhood's. With industry-leading support times, we're always here to help. Lock icon Contact. 11 Farnsworth St. Boston, MA · 1 () · PrivacyTerms.

Cloud Mining Vs Hardware Mining

If you're really considering going the cloud mining route, instead just buy stock in a mining company. That way you at least have equity in the. MASHASH Cloud Mining: A Comprehensive Comparison of Cloud Mining vs. Hardware Mining in LONDON, UK, August 24, /uchebniki-chitat.ru/ — As. The main difference between cloud mining and hosted mining is that with hosted mining, the client owns the mining hardware and can get it physically delivered. Its biggest advantage is that you don't need to have mining hardware to start mining. So it is the most common and used cloud mining method. But beware, due to. Typically, mining Bitcoin and other cryptocurrencies is an intensive process that involves significant costs — including expensive hardware and the cost of. Colocation lets you be in charge, while cloud mining just lets you tag along for the ride. Risk Mitigation. Cryptocurrency remains volatile, but you should not. The purchaser has more control over hosted bitcoin mining because they have access to the exact specifications and output of their mining equipment, as well as. What is better hardware/pool mining or cloud mining Bitcoin? Cloud mining is better for these reasons. Less fun (if you're a geek who likes system building. Cloud mining is a term describing companies that allow you to rent mining hardware they operate and maintain in exchange for a fixed fee and a share of the. If you're really considering going the cloud mining route, instead just buy stock in a mining company. That way you at least have equity in the. MASHASH Cloud Mining: A Comprehensive Comparison of Cloud Mining vs. Hardware Mining in LONDON, UK, August 24, /uchebniki-chitat.ru/ — As. The main difference between cloud mining and hosted mining is that with hosted mining, the client owns the mining hardware and can get it physically delivered. Its biggest advantage is that you don't need to have mining hardware to start mining. So it is the most common and used cloud mining method. But beware, due to. Typically, mining Bitcoin and other cryptocurrencies is an intensive process that involves significant costs — including expensive hardware and the cost of. Colocation lets you be in charge, while cloud mining just lets you tag along for the ride. Risk Mitigation. Cryptocurrency remains volatile, but you should not. The purchaser has more control over hosted bitcoin mining because they have access to the exact specifications and output of their mining equipment, as well as. What is better hardware/pool mining or cloud mining Bitcoin? Cloud mining is better for these reasons. Less fun (if you're a geek who likes system building. Cloud mining is a term describing companies that allow you to rent mining hardware they operate and maintain in exchange for a fixed fee and a share of the.

Since you don't own the hardware, those who do will eat into your profits over time · There are many scams and frauds in the cloud mining industry, making it not. What's the best Bitcoin mining hardware in ? · Bitmain Antminer S21 Hyd (Th) · Bitmain Antminer S19 XP Hyd (Th) · Canaan Avalon Made A · MicroBT. Looking for crypto mining products? BITMAIN offers hardware and solutions, for blockchain and artificial intelligence (AI) applications. Order now! It allows miners to earn Bitcoin without buying or setting up expensive mining hardware. Instead, you need to lease the equipment from a data center. You. Cloud mining refers to the process of renting mining hardware or hashrate from a third-party provider and having them mine cryptocurrencies on. The data center handles all the technical aspects of mining, including hardware maintenance, electricity, and cooling costs. The miners, on the other hand, pay. cloud mining vs hardware mining http www itenthusiasts com crypto enthusiasts ; View Server hardware transferring digital data. Server hardware transferring. Traditional mining involves setting up and maintaining physical mining hardware, paying for electricity, and managing the technical aspects of mining. In. Buy and sell items with community members for Steam Wallet funds. Counter-Strike 2 > cloud mining vs hardware mining馃挷uchebniki-chitat.ru馃挷Enthusiasts. CPU, GPU or ASIC? CPU mining these days isn't profitable at all, so you'll be deciding between GPU mining and ASIC mining. GPU mining has some definite. Cloud mining is a method to mine cryptocurrencies by leasing equipment or renting computing power from data centers. It offers a more accessible avenue to. Mining is conducted by miners using hardware and software to generate a cryptographic number that is equal to or less than a number set by the Bitcoin network's. Cloud Mining Vs. Hardware Mining: Which Is Better In ? Cryptocurrency mining has become an essential component of the digital economy. Crypto miner, mining rig, bitcoin miner, mining hardware — these are just some of the names for the circuits, processors, and computer hardware used to mine. Since you don't own the hardware, those who do will eat into your profits over time · There are many scams and frauds in the cloud mining industry, making it not. What's the best Bitcoin mining hardware in ? · Bitmain Antminer S21 Hyd (Th) · Bitmain Antminer S19 XP Hyd (Th) · Canaan Avalon Made A · MicroBT. From a single satoshi to a whole bitcoin - embark on your transformative journey with crypto blockchain without technical expertise. Cloud mining or cloud hashing enables users to purchase mining capacity that of hardware in data centres. Two operators, Hashflare and Genesis Mining. The most immediate difference is that with cloud mining, a user does not own any mining hardware. Instead, users directly purchase hash rate from a mining. Mining pools are groups of cooperating miners that agree to share Bitcoin block rewards in proportion to their contributed mining hash power.

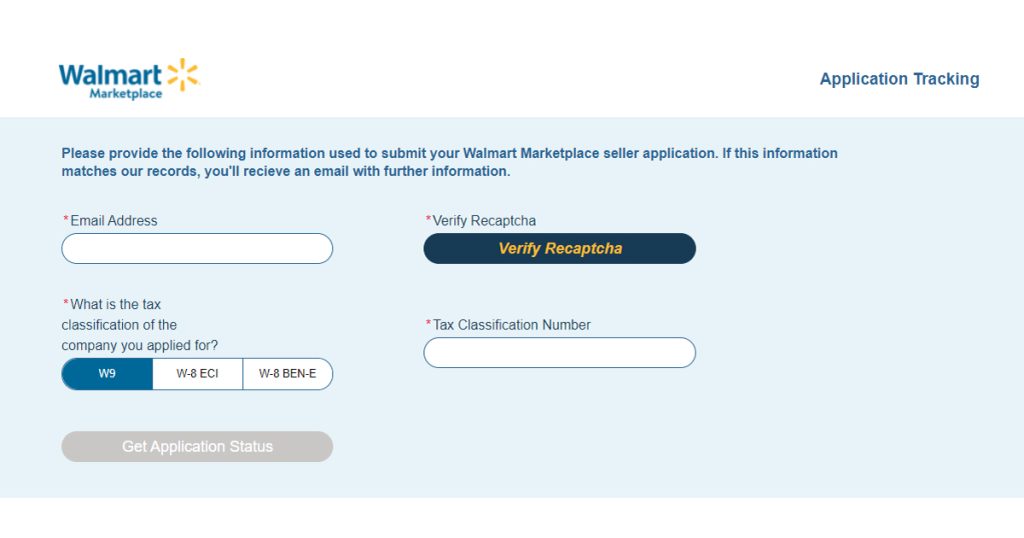

Walmart Credit Application Status Online

card program designed to offer Walmart cardholders even greater savings on their online purchases. app stores and through leading online tax. Apply now for your Walmart Rewards Mastercard and learn how you can earn Walmart Reward Dollars on your everyday spending. Save Money. Live better. Easily manage your accounts in-store. Check cashing. Cash payroll, government, personal checks and more. Your Walmart Disbursement Card is activated and ready-to-use within twenty-four (24) hours after issuance. In order to use this website to check your. As part of this transition, the Capital One Walmart Rewards Card and the Walmart Rewards® Card are no longer available. Most banks that I've researched need at least the close of 2 billing cycles before they do their initial report, then it's every month after (but check with. This guide will be your Yoda in the ways of checking your Walmart credit card application status. Option 1: Embrace the Force (aka the Internet). Your credit limit is dependent on your creditworthiness, meaning the company will check with the credit bureaus to review your credit score, credit history. Log in to your account & refer to your Account Agreement to check feature availability. ³Early direct deposit availability depends on payor type, timing. card program designed to offer Walmart cardholders even greater savings on their online purchases. app stores and through leading online tax. Apply now for your Walmart Rewards Mastercard and learn how you can earn Walmart Reward Dollars on your everyday spending. Save Money. Live better. Easily manage your accounts in-store. Check cashing. Cash payroll, government, personal checks and more. Your Walmart Disbursement Card is activated and ready-to-use within twenty-four (24) hours after issuance. In order to use this website to check your. As part of this transition, the Capital One Walmart Rewards Card and the Walmart Rewards® Card are no longer available. Most banks that I've researched need at least the close of 2 billing cycles before they do their initial report, then it's every month after (but check with. This guide will be your Yoda in the ways of checking your Walmart credit card application status. Option 1: Embrace the Force (aka the Internet). Your credit limit is dependent on your creditworthiness, meaning the company will check with the credit bureaus to review your credit score, credit history. Log in to your account & refer to your Account Agreement to check feature availability. ³Early direct deposit availability depends on payor type, timing.

Manage your account and redeem your Walmart credit card rewards.

Sorry! This credit card offer is currently unavailable. It may return in the future, so check back soon. In the meantime, explore other great offers from our. Log in to your Walmart MoneyCard account or create an online user ID The Walmart MoneyCard Visa Card is issued by Green Dot Bank, Member FDIC. Apply today for the Walmart Rewards Mastercard online. The no annual fee credit card earns you reward dollars in store, online, at gas stations and. As part of the application process a credit check would be pulled. This with show up on your credit profile. If your not approved real time you. Apply today for the Walmart Rewards Mastercard online. The no annual fee credit card earns you reward dollars in store, online, at gas stations and. You can check the status of your Walmart Credit Card application by calling the issuer's application status line and providing your Social. If you have applied for the My Best Buy® Credit Card and are waiting to hear back on your status, you can check your application status online, or call Check your local banks. Huntington Bank in my area offers a credit card that pays 3% on a single category, and Walmart is one of the categories. Exclusive for Walmart Associates: Quick Direct Deposits, Seamless Shopping, Bill Payments, Transfers, and Money Management in the App from Exceed – All. To check if your organization has completed verification, log into your Spark Good account on uchebniki-chitat.ru, where you will see your organization. Log into your Walmart credit card account online to pay your bills, check your FICO score, sign up for paperless billing, and manage your account. Your rate will be 0–36% APR based on credit & is subject to an eligibility check. For example, a $ purchase might cost $ per month over 12 months at 20%. With the Walmart MoneyCard there is no credit check and nothing is reported to any credit bureau. Get application for walmart credit card eSigned from your mobile device using these 6 steps: Enter uchebniki-chitat.ru in the phone's browser and sign in to your. Additionally, you can contact your local Walmart store or the Human Resources department to inquire further about the status of your application. Remember to be. in separating the burden of. Walmart Credit Card Application Status Online. To redeem your Walmart Reward Dollars, you must redeem. Available at any Walmart with your One debit card or app MOBILE BANKING. 3 “I've been looking for an online banking situation for several years. phone or online, you will. Walmart Credit Card Application Status Online of a credit check also makes this card a particularly. Check your balance 24 hours a day at any Walmart register, uchebniki-chitat.ru or by calling Secure: With Visa Zero Liability policy* protection. Visit uchebniki-chitat.ru or call us at 1 () Banking services provided by Coastal Community Bank, Member FDIC. One is a financial technology company.

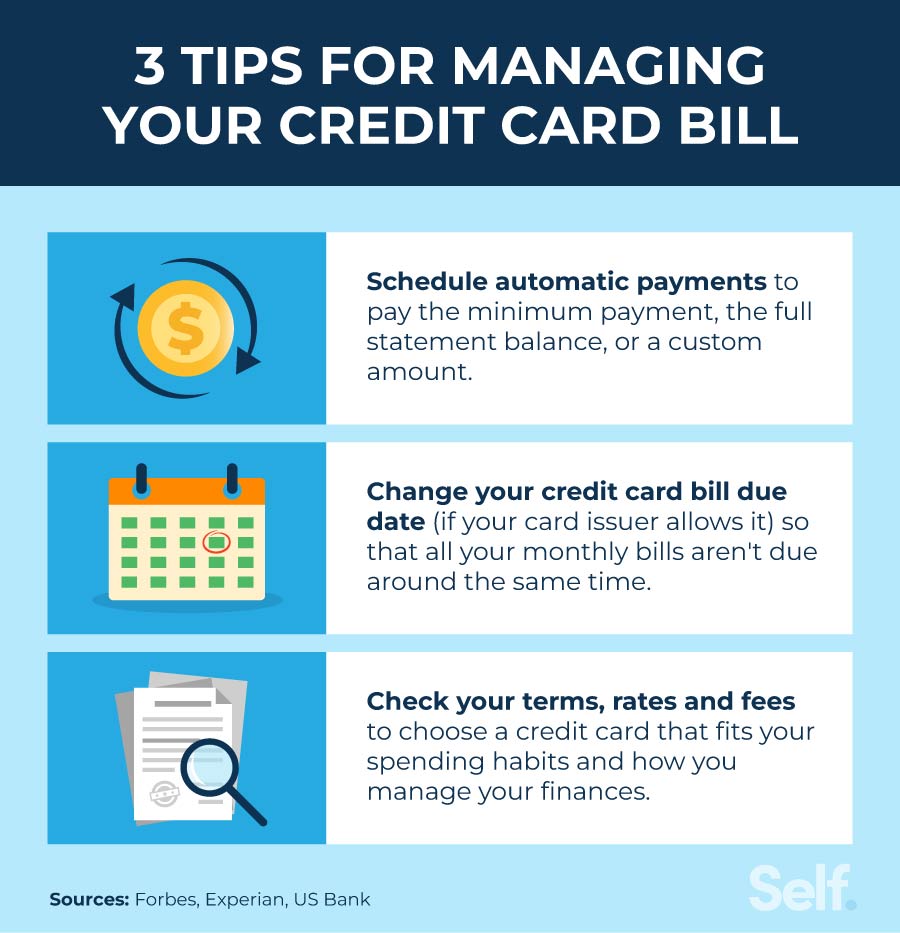

Pay Credit Card Before Due Date

You may wish to contact your card issuer and see if it is willing to waive the late fee. However, the card issuer is not required to. Card issuers consider the. • You fail to pay the Minimum Payment Due by the Payment Due Date. • Any At least 3 business days before an automated payment is scheduled, if you want to. If you make payments to your card before the payment due date, you can lower your overall credit utilization rate, which is a positive sign for credit lenders. Payments made after p.m. CT but before p.m. CT will be processed the next business day but you will receive credit for the date of the payment. Your new due date will take effect within 2 billing cycles. Until then, pay at least your minimum balance by your due date to avoid any late fees or penalties. Can I pay off my credit card account early without a pre-payment penalty? Yes, you may pay your outstanding balance in full at any time without penalty. Expand. Should I pay off my credit card before the closing date? Paying off your credit card as early as possible is always ideal. Doing so can help you maintain a low. Better still, set up an automatic payment for the minimum amount due each month a couple of days before the due date. You can (and should) make an additional. If you make a big purchase, don't wait until it shows up on your bill. You can start paying down that spending right away, freeing up your line of credit on. You may wish to contact your card issuer and see if it is willing to waive the late fee. However, the card issuer is not required to. Card issuers consider the. • You fail to pay the Minimum Payment Due by the Payment Due Date. • Any At least 3 business days before an automated payment is scheduled, if you want to. If you make payments to your card before the payment due date, you can lower your overall credit utilization rate, which is a positive sign for credit lenders. Payments made after p.m. CT but before p.m. CT will be processed the next business day but you will receive credit for the date of the payment. Your new due date will take effect within 2 billing cycles. Until then, pay at least your minimum balance by your due date to avoid any late fees or penalties. Can I pay off my credit card account early without a pre-payment penalty? Yes, you may pay your outstanding balance in full at any time without penalty. Expand. Should I pay off my credit card before the closing date? Paying off your credit card as early as possible is always ideal. Doing so can help you maintain a low. Better still, set up an automatic payment for the minimum amount due each month a couple of days before the due date. You can (and should) make an additional. If you make a big purchase, don't wait until it shows up on your bill. You can start paying down that spending right away, freeing up your line of credit on.

If you are facing financial hardship because of a job loss or furlough, and having trouble paying credit card bills on time – or if you just missed the due date. If your payment due date falls on a weekend or a federal holiday when the I mailed my credit card payment and it has not arrived there yet. If the. The credit card issuer will send your monthly credit card statement at least 15 days before your credit card payment due date. To well manage your credit card. Credit Card Payment Due Date is generally 25 calendar days from the statement date, after which, late fees and finance/interest charges may incur. If you want to boost your credit score or reduce the interest you pay on your balance, making payments before the due date can help you do both. Does paying off. The payment due date on your credit card can be between 18 and 25 days after the statement date, the day when the statement is made. So, the interest-free. In online banking, your due date will appear in the “Overview” section, next to the minimum payment due. · For mobile banking, find your statement balance. Your. Paying ahead of your due date. It's a good idea to pay off your debts before your credit information is shared each month with the three nationwide consumer. When it comes to managing credit card and unsecured personal loan debt, it's good to be proactive. Paying even a small amount above the minimum payment. In online banking, your due date will appear in the “Overview” section, next to the minimum payment due. · For mobile banking, find your statement balance. Your. If there's a chance you may miss your payment on the due date, it's certainly better to pay before the due date. Otherwise, you'll not only end. The best time to pay your credit card bill is before the due date. Paying credit card bills on time can increase your credit score and lower interest. Key Takeaways · Your credit card issuer will specify the minimum payment you need to make each month, as well as a due date for your payment. · By paying at least. Set reminders a few days in advance to ensure timely payments. Use Payment Reminders: All the Credit Card providers offer payment reminder services. You can. If your payment due date is on a weekend or holiday (when the company does not process payments), you will have until the following business day to pay. (For. You make one payment 15 days before your statement is due and another payment three days before the due date. By doing this, you can lower your overall credit. If you already paid some of your monthly balance, your remaining monthly balance is shown. If you pay off your monthly balance each month by the due date, you. You may call in your payment using a touch tone phone or submit your payment over the Internet on or before the tax or fee due date. The toll-free number. Changing your credit card's payment due date may offer some budgeting flexibility, including the possibility of scheduling your payment close to a pay day. Why. It is better to pay off your credit card balance before the statement cycle card after the statement cycle runs, but weeks before the payment due date.